About the Client

Top Insurance Player

Case Study

Planning and Predicting insurance claim costs using TeraWiz™ Predictive Analytics Solution

Problem Overview

Insurance companies provide new claims to many future and current clients. However, insurers want to understand the potential cost involved in new claims. The TeraWiz™ solution allows insurance providers to predict actual cost of specific claim as soon as they are filed

TeraCrunch Solutions

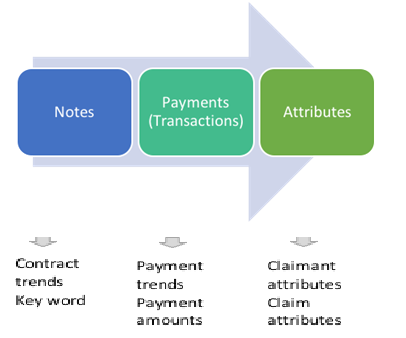

The TeraWiz™ solution's data source consists of claims data and unstructured qualitative claim notes. Using this data, TeraCrunch customized its base Socratez™ technology and its algorithms, to develop an interactive tool that predicts claim cost as soon as a new claim is filed. The interactive tool provides actionable insights so adjusters are able to close claims and reduce claim costs. TeraWiz™ solution uses a three dimensional dynamic predictive model that gathers key phrases with high decile payouts making the outcomes strong predicators.

Impact On the Business

Utilizing the TeraCrunch Solution, the Insurance client is able to reduce loss time status on claims, improve the claim handling process, and reducing cost per claim along. They can sprioritize high cost claims in contrast with low cost claims.