About the Client

Telecom Service Provider/Retailer

Case Study

Predicting which customers will churn and why, is a crucial need for many clients. In this case study, TeraCrunch advanced analytics is applied to increase the targeting effectiveness of a marketing plan to combat customer churn.

Problem Overview

The client has a strong desire to reduce the rate at which their customers churn and move to another carrier. However, churn is a multifaceted problem, as many different factors can relate a customer’s risk of leaving, including both factors that can be controlled, those that cannot, and factors that are merely symptomatic of churn risk. Thus, there is a strong need for a rigorous approach to model customer churn risk, especially in identifying those pain points or triggers that can be mitigated by targeted marketing interventions.

TeraSmart™ Customer Experience Management (CEM) Solution Customization

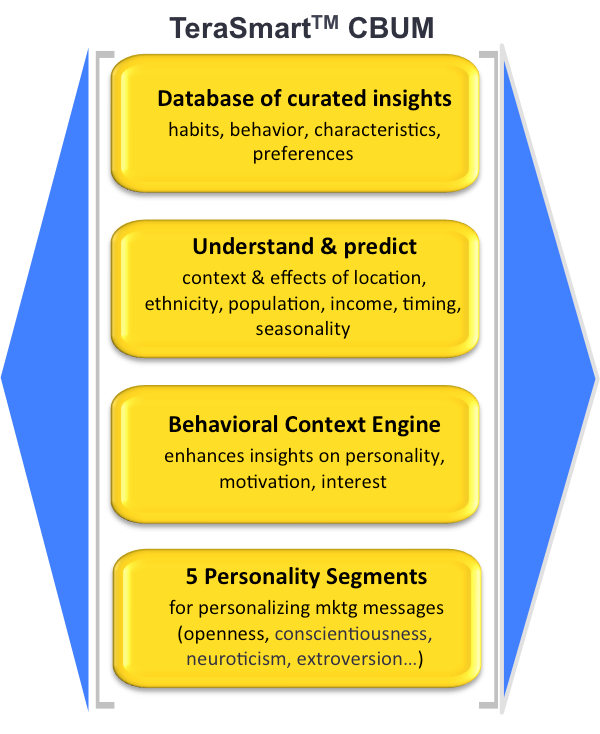

TeraSmart™ CEM is a stack of analytics modules aimed at providing a new level of insight into complex human behavior and the impact of many variables on the individual and the group. It is designed to create a multi-dimensional understanding of customers and their motivations, habits, interests, and preferences, as well as to predict the effects of location, ethnicity, population, income, timing, and seasonality on customer behavior. It is applied with customizations to reducing churn, increasing acquisition, and increasing revenue per-customer. It can also be used to create personality segments in order to help marketing teams target highly personalized marketing messaging and increase take rates.

Our data science team took a diverse set of customer data of varying relevance to customer churn from the client and customized our TeraSmart™ CEM solution to determine why customers churned, which factors were most important in contributing to each customer's risk churn, and how each customer's sensitivity to these pain points vary with ancillary demographic variables.

In one of our initial trial campaigns, a marketing intervention was found to be twice as effective at reducing churn when targeting a customer segment that we devised when compared to the same marketing intervention applied to the general high-churn-risk population.

Impact On the Business

The client is able to optimize marketing campaigns to ensure the right message is being delivered to the customer segments most sensitive to the message. In our trials, we saw a double-digit reduction in churn in the populations treated by our marketing campaigns.